SoCal Industrial Leasing Normalizes from Hot Streak

- June 25, 2024

- News

- Read

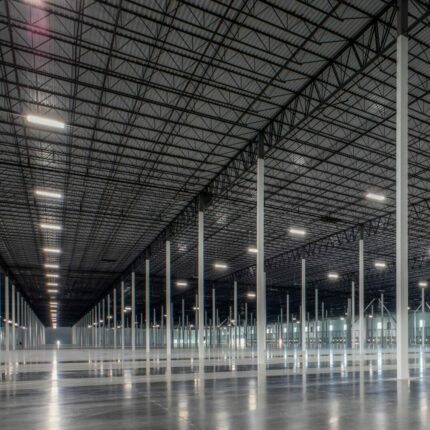

Like the rest of the country, the industrial market in Southern California was red hot a couple of years ago. It was characterized by high demand and limited supply, resulting in record-breaking absorption rates and rent growth.

It seems that all of that has come to a halt. While that halt isn’t a crashing one, it is noticeable to those involved with commercial real estate. While some might be worried about the current state of affairs, market and industrial experts contacted by Connect CRE aren’t. As Lee & Associates’ Senior Vice President and CEO Jeff Rinkov explained, “The notable trend when it comes to today’s Southern California industrial market can be summarized as ‘normalization.’”

Markets by the Numbers

The numbers support what Rinkov called “normalization.” During Q1 2024, SoCal industrial market reports showed vacancy and rental rates returning closer to normal pre-COVID levels in the small-to-mid size building segment, coupled with negative absorption and decreasing rent rates versus the same period in 2023. Year-over-year construction also declined.

Even so, “the SoCal industrial market is experiencing an oversupply of industrial space,” said CT Realty’s Managing Partner Carter Ewing, particularly in the smaller size segments that were abundant and (therefore) much easier to acquire, entitle, and construct than the more complicated (and limited) larger sites across the region. “This supply imbalance has been driven by a decrease in demand due to macroeconomic factors over the past 18 months, coupled with an excessive amount of new construction over the past couple of years.”

Nor are growing rates of sublease space helping the situation. James Camp pointed out that sublease space at discounted rates is currently flooding the Inland Empire market, exacerbating already high construction deliveries amid softening tenant demand.

As a result, “for the first time in my career, the Phoenix and Las Vegas markets performed much better than that of the Inland Empire,” said Camp, who serves as Rockefeller Group’s Senior Managing Director, West.

Roots of Today’s Extra Space

Why is SoCal suddenly seeing a glut of industrial space? In truth, there isn’t anything “sudden” about the deliveries. The root of the current situation is traceable to COVID-19.

Between 2020 and 2021, “stay-at-home” mandates and government stimulus checks prompted people to shop via their keyboards. According to SIOR Past President and JLL President and Global Chair/Industrial Craig Meyer, SIOR, online sales before the pandemic represented 11% of total retail sales. In 2020, that number soared to 20%, he said.

To meet that customer demand, e-commerce companies and third-party logistics providers needed warehouse space and distribution centers – and fast. This, in turn, spearheaded rapid, record-breaking industrial construction, particularly in the smaller size segments where vacant land sites were more abundant, as Ewing points out.

Lexi Geiger, Bixby Land Co.’s Director of Acquisitions, explained that unprecedented demand, in addition to the record number of deliveries, drove lease rate growth to over 200% in some submarkets. Meanwhile, higher rents drove some tenants out of California, she added.

The online sales situation has changed these days, with the most recent report (Q1 2024) indicating that online purchases accounted for 15.9% of total sales.

But the space keeps on coming. “The developments currently being delivered were planned in late 2020 and early 2021 in response to the acceleration of e-commerce,” Rinkov said. “At that time, it seemed like that online demand would never stop or that no one would ever go to a store again.”

The additional space combined with softening demand has meant higher vacancies, slower absorption, and depressed rents. Furthermore, “the abundance of supply, combined with investor yields that continue to expand, creates a very difficult environment for spec development,” observed CapRock Senior Vice President Taylor Arnett.

To summarize, “The entire U.S. industrial market is coming off a COVID high,” Meyer commented.

Don’t Underestimate Ports – or Populations

One reason why the experts believe the current situation is more pause than permanent is Southern California fundamentals. And one of the main factors driving those fundamentals is the Southern California Ports.

Following somewhat lagging numbers in 2023, the Ports of Los Angeles and Long Beach reported year-over-year growth in February 2024. The Port of Los Angeles’s total volume grew 60% year over year, while the Port of Long Beach experienced a 24% increase from February of the previous year.

A factor positively impacting the West Coast ports is what happens on the opposite coast, specifically labor disputes and contract negotiations. Josh Cox, Hillwood Senior Vice President and NAIOP-Inland Empire President-Elect said labor issues impacting the East Coast ports had been a positive boon for those on the West Coast. “We figured out all the labor agreements last year,” he explained.

In other news, following years of decline, the California population is on the rise, ticking upward by 0.17% in 2023. Much of the growth took place in the Southern California counties.

Though 0.17% isn’t a massive influx of folks, “the main counties in Southern California have a population of around 17.6 million,” Cox said. The dense population in those counties, combined with increased port activity, means “the demand for industrial space isn’t going away any time soon,” Cox pointed out.

Rockefeller’s Camp added that the increased product arrivals on the Long Beach and Los Angeles docks, coupled with a large population, mean that Southern California tenants will need more logistics centers, warehouses and other industrial buildings.

What do the Tenants Want?

In the wild days of the 2020-2021 e-commerce boom, SoCal industrial tenants took what little space there was and were glad to have it. But the situation is now becoming a tenant’s market. And the tenants are demanding specific things.

Bob O’Neill, senior vice president, acquisitions with CapRock, explained that Inland Empire tenants serving the port—especially those taking down more than 500,000 square feet—need trailer storage and plenty of it. In the past, tenants made do with storage available in standard 185-foot truck courts, but not these days.

“When possible, additional trailer storage should be located adjacent to the warehouse in lieu of the developer constructing another smaller building,” O’Neill said. “If excess land associated with a project is not available, tenants typically require storage to be located at an off-site location as close to the distribution center as possible.”

Tenants are also looking for higher ceilings in their facilities. “Most tenants with space above 500,000 square feet prefer distribution buildings with 40-foot clear heights,” O’Neill said. This is above the previous market standard of 36-foot clearance, he added.

Bixby’s Geiger also stressed the need for building functionality, explaining the importance of clear heights, truck court depths and expanded trailer parking. “Users today are more focused on regulatory issues, supply chain resiliency and determining appropriate levels of inventory,” she added.

Another need is size – but smaller rather than larger. “Longer term, we believe smaller, regional warehouses will be in demand as users focus on their proximity to customers and work to speed up their delivery times,” Geiger observed.

Then again, some tenant needs have remained constant over the years. “They all want convenient access to freeways and major transportation corridors, with locations proximate to the ports to minimize the amount of drayage,” Camp pointed out.

Leasing, Now and the Future

The consensus on SoCal industrial leasing trends is that there’s nothing unusual going on.

“This is a phenomenon that always has, and always will, follow a white-hot market like the one we all enjoyed up until 2022,” said CapRock’s Arnett. Meanwhile, he added that healthy market fundamentals and barriers to entry, like land availability and long entitlement processes, tend to favor the sector.

Furthermore, though current leasing demand is softer than in previous years, “we’re seeing an increase in qualified inquiries, tours and letters of intent over the past 120 days,” commented Luke Staubitz, SIOR, executive vice president with Kidder Mathews. Staubitz anticipated that absorption rates should improve with rent reductions and increased concessions, while Camp forecasted that negative absorption should stabilize by the end of 2024. “There are very few new projects getting underway in 2024 due to lack of construction financing and JV equity capital,” Camp added. “We expect by mid to late 2025 to be a return to pre-pandemic normal absorption and lease rates.”

Meanwhile, Meyer said that extra space on the market should be leased within two to three years. Geiger agreed, adding that e-commerce growth and consumer demand for faster delivery times should further drive industrial sector growth. Optimism extends to the ultra big box end of the market as well. “Keep in mind that there are only one or two buildings over 800,000 square feet currently available in the whole of Southern California,” said Chase Watson, VP of Leasing and Marketing for CT Realty, “from the San Fernando Valley to the Mexican Border, rates and demand in the million-square-foot big box segment of the market has held up exceptionally well.”

Finally, Geiger and Lee & Associates’ Rinkov believe that the high-quality, Class A square footage coming online now is well-positioned for future absorption.

“This is an important time for tenants, landlords, investments and brokers,” Rinkov said. “While the market isn’t as transactional as it has been, it’s important for brokers to communicate where they see the trends. It’s a matter of skating to where the puck is going, not where it is right now.”